Read the complete article and watch the video on the LoHud website.

The year-end rush to make charitable donations before federal tax reform kicked in left some nonprofits brimming with cash when 2018 dawned.

But many nonprofit executives in the Lower Hudson Valley are worried that tax reform will remove the incentive to give in 2018 because far fewer Americans will itemize their deductions.

The doubling of the standard deduction — to $12,000 for individuals and $24,000 for married couples — could prove a boon to many low- and middle-income filers. But that benefit means it will make financial sense for some to take the standard deduction instead of itemizing because their deductions may not exceed the threshold.

Nationwide, about 30 percent of Americans itemize, which means they can deduct their charitable donations from their taxable income. In New York, filers get back up to 45 percent of what they give in state and federal tax savings.

The number of Americans who itemize could dip to as low as 5 percent, according to Una Osili, associate dean for research at the Lilly Family School of Philanthrophy at Indiana University.

“Americans will still give, but the incentives will be more concentrated among the wealthy,” she said. “They will be less effected by the change.”

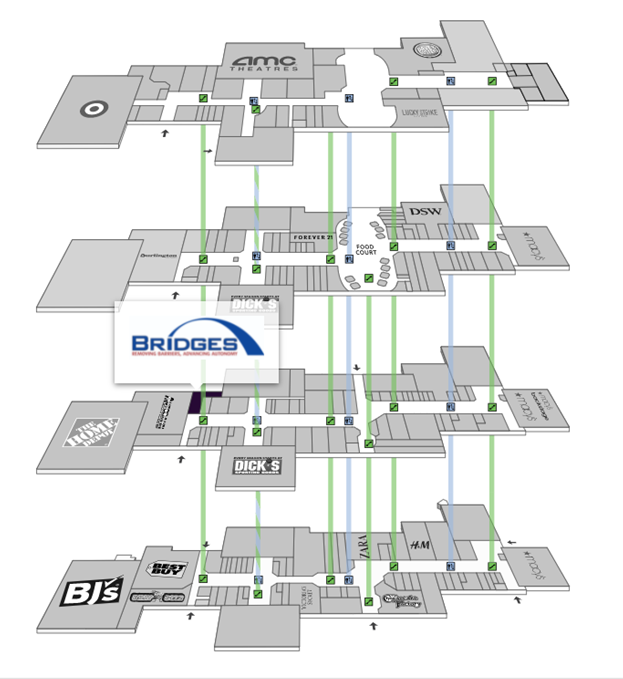

David Jacobsen, executive director of Bridges, a New City nonprofit that works with 30 agencies to foster independence among Rockland County residents in need, said the full impact of the tax bill won’t be known for a year or two, when taxpayers see how their personal situations shake out.

“It could cause problems if giving habits change,” Jacobsen said.

Read the complete article and watch the video on the LoHud website.